Are Amazon Purchases Tax Deductible? A 2025 Guide

If you're a freelancer, small business owner, or self-employed professional, you've probably wondered: Can the things I buy on Amazon be tax deductible?

The short answer is yes—but only if those purchases are ordinary and necessary for your business. In this guide, we'll break down what qualifies, what doesn't, and how to make sure you're capturing every deduction you deserve.

Don't want to sort through hundreds of orders manually? Let us find your deductions →

What Makes an Amazon Purchase Tax Deductible?

According to the IRS, a business expense must be both ordinary (common and accepted in your trade) and necessary (helpful and appropriate for your business). This applies to Amazon purchases just like any other vendor.

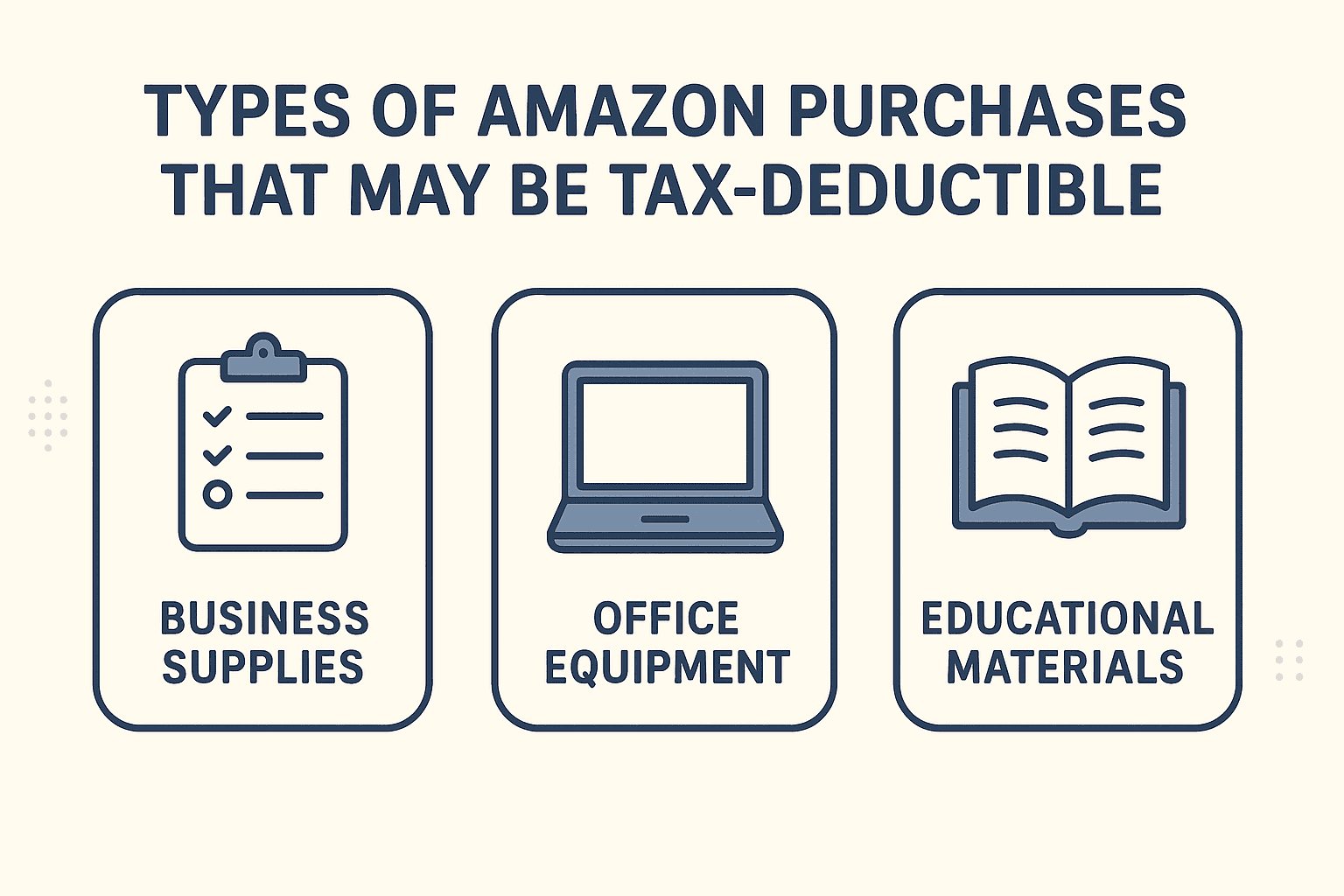

Common Deductible Amazon Purchases

Here are categories of Amazon purchases that often qualify as business deductions:

- Office Supplies: Notebooks, pens, printer ink, paper, folders, and organizational tools

- Technology & Equipment: Computers, monitors, keyboards, webcams, microphones, and cables

- Software Subscriptions: Digital downloads of business software

- Books & Learning Materials: Industry-related books, courses, and educational content

- Home Office Furniture: Desks, chairs, shelving (if used exclusively for business)

- Shipping Supplies: Boxes, tape, labels, and packaging materials for product-based businesses

What Doesn't Qualify

Not everything you buy on Amazon is deductible, even if you use it while working:

- Personal Items: Snacks, personal clothing, household goods

- Mixed-Use Items Without Documentation: A laptop you use 50% for business and 50% for Netflix requires careful allocation

- Capital Expenses Over $2,500: Large purchases may need to be depreciated over time rather than deducted immediately

The Home Office Deduction and Amazon Purchases

If you work from home, many Amazon purchases become deductible under the home office deduction. Items like desk lamps, storage solutions, and even a comfortable office chair can qualify—as long as they're used exclusively (or primarily) for business.

Pro Tip: Keep your home office items separate from personal use to strengthen your deduction claims. The IRS looks for "exclusive and regular use" when evaluating home office deductions.

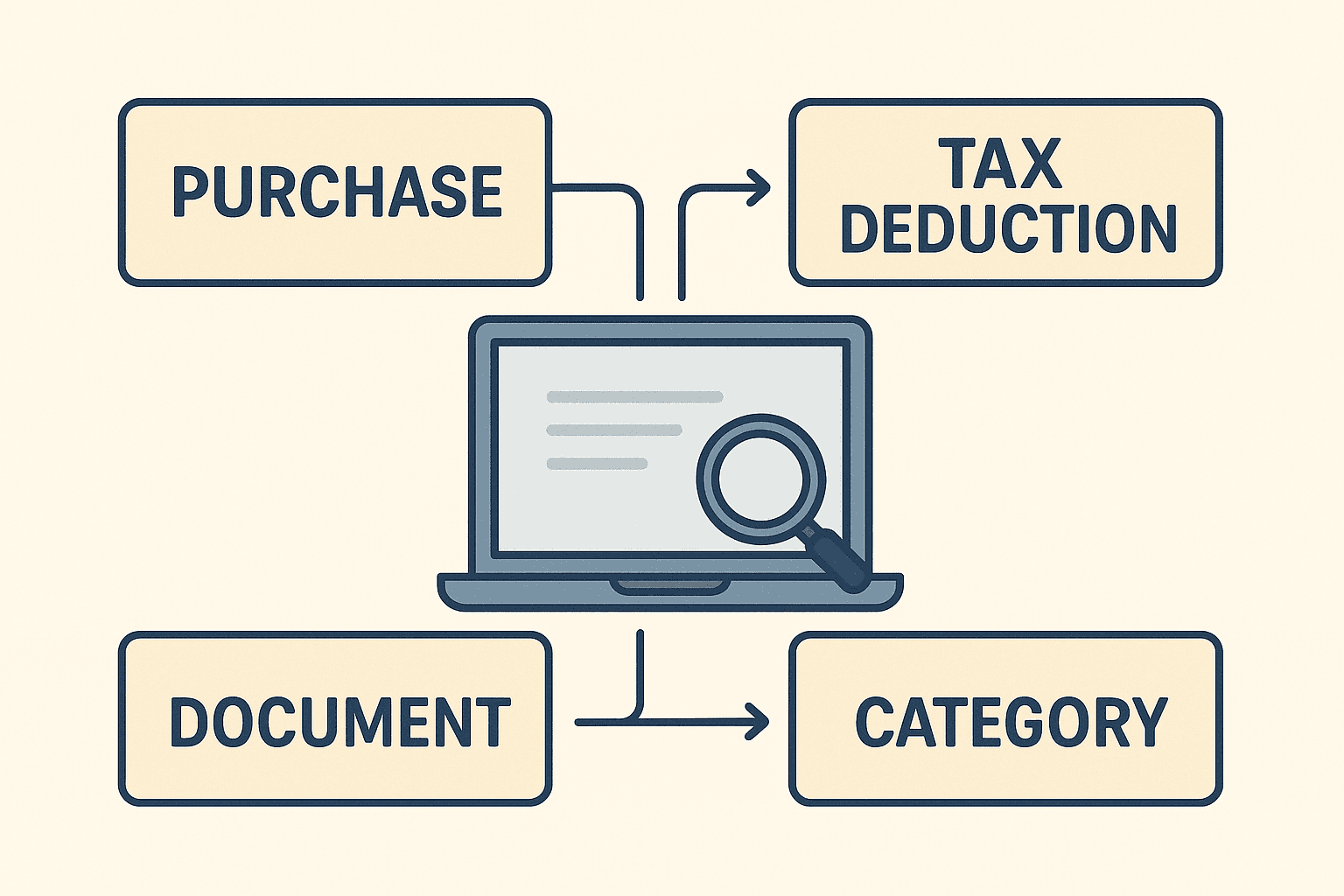

How to Track Amazon Purchases for Tax Purposes

The biggest challenge isn't knowing what's deductible—it's tracking and documenting those purchases throughout the year. Here's how to stay organized:

1. Download Your Amazon Order History

Amazon allows you to export your order history. This gives you a complete record of purchases to review at tax time.

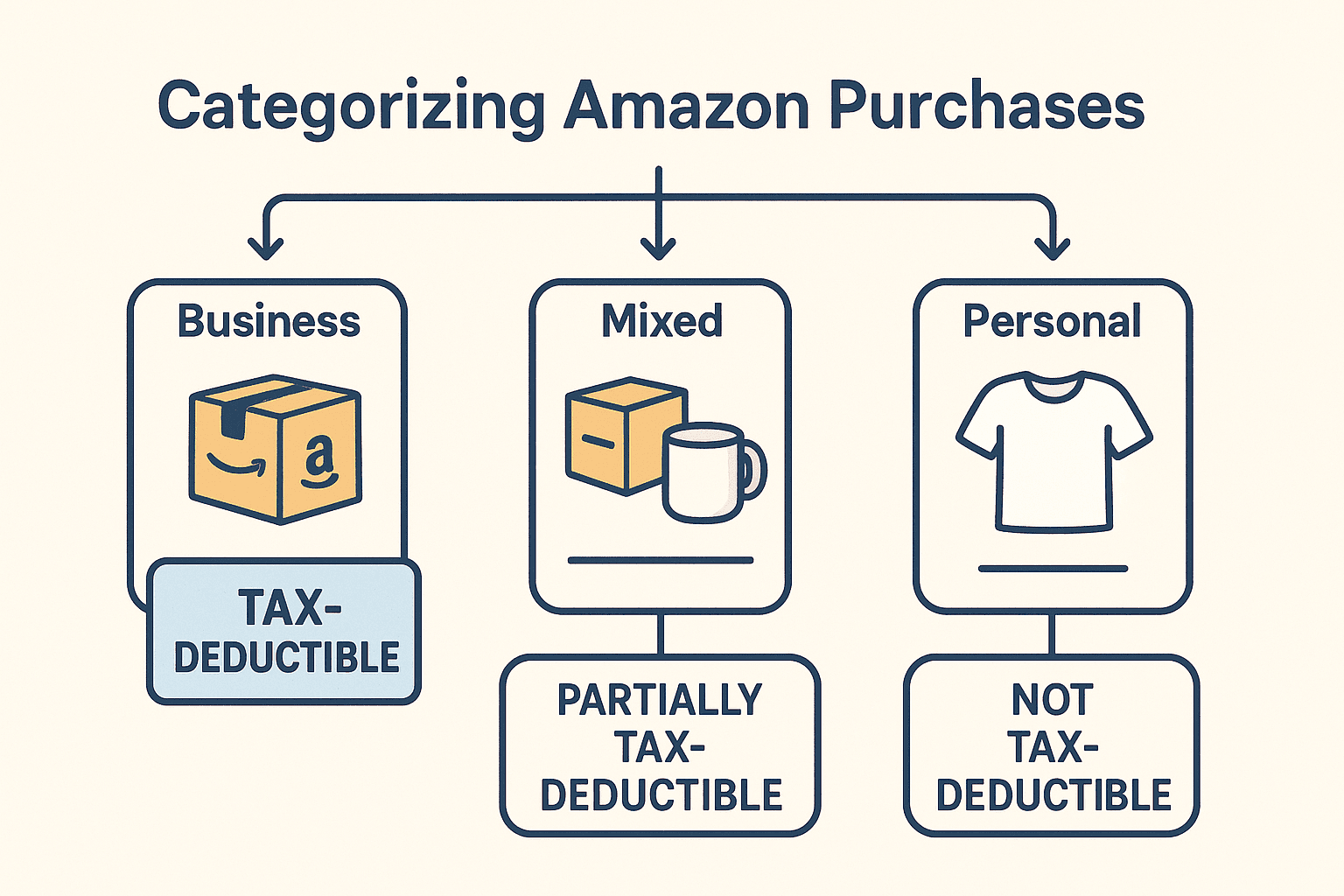

2. Categorize by Business Use

Go through each purchase and categorize it:

- 100% Business: Fully deductible

- Partial Business Use: Calculate the percentage

- Personal: Not deductible

3. Save Your Receipts

Keep digital copies of receipts and invoices. Amazon makes this easy with email confirmations and order details.

4. Use a Dedicated Business Account

If possible, create a separate Amazon account for business purchases. This makes year-end reconciliation much simpler.

Real Examples: What's Deductible?

| Purchase | Deductible? | Notes |

|---|---|---|

| Standing desk for home office | Yes | Home office furniture qualifies |

| Ring light for video calls | Yes | Professional equipment |

| Coffee maker for office | Maybe | Must be in dedicated business space |

| Business books | Yes | Educational materials for your trade |

| Wireless headphones | Partial | Split personal/business use |

| Shipping boxes (for Etsy shop) | Yes | Direct business expense |

Common Mistakes to Avoid

1. Not Keeping Records

The IRS requires documentation. "I remember buying it" isn't enough.

2. Deducting Personal Items

That ergonomic pillow might help you work longer, but if it's not clearly business-related, skip the deduction.

3. Forgetting Amazon Business Purchases

Many people forget about Prime membership fees, AWS charges, or Kindle Unlimited for business reading.

4. Missing Partial Deductions

If you use your iPad 70% for business, you can deduct 70% of the cost—don't skip it just because it's not 100%.

This is exactly why we built Purchase Deductions

Instead of manually reviewing hundreds of orders, our software automatically categorizes your Amazon purchases and calculates your deductions in seconds.

Get Early AccessHow Purchase Deductions Can Help

Manually reviewing hundreds of Amazon purchases is tedious and error-prone. Purchase Deductions automates this process:

- Import your Amazon order history

- AI Analysis categorizes each purchase by deductibility

- Generate Reports ready for your accountant or tax software

We help freelancers, consultants, and small business owners find deductions they'd otherwise miss—often hundreds or thousands of dollars per year.

Key Takeaways

- Amazon purchases can be tax deductible if they're ordinary and necessary for your business

- Documentation is critical—keep receipts and categorize purchases throughout the year

- Home office items often qualify, especially with exclusive business use

- Partial deductions count—don't skip items just because they have some personal use

- Automate the process with tools like Purchase Deductions to maximize your savings

Stop Missing Deductions

Small business owners typically miss 20-40% of legitimate Amazon deductions every year. Let Purchase Deductions find yours automatically.

Free to join. Be first to know when we launch.

Ready to Find Your Deductions?

Join the waitlist and be first to know when we launch.

Get Early Access